A HIGHER DEGREE OF COMMUNICATION AND GUIDANCE, EVERY STEP OF THE WAY

With an experienced mortgage professional on your side, the steps to buying a home are easy to climb. We help clients smoothly secure the right loan for their current situation. Whether you’re looking for a new home loan or want to refinance an existing mortgage, we guide you through the process and share our expertise and insights, every step of the way.

We make sure that when our clients sit down with the notary to sign the final papers, they have had all options explored, terminology explained, and all questions answered. All they need to do is put pen to paper and sign with the confidence that comes with being fully informed from beginning to end.

HOW IT WORKS

> OUR PROCESS

SCHEDULE A FREE CONSULTATION

Starting your journey to home ownership or refinancing is as easy as picking up the phone. Let’s talk about what you are looking for, both in a house and in a mortgage.

You probably have a lot of questions, and our clients can depend on us to look at the whole picture and offer them valuable, no-nonsense advice. We can even go over types of loans that you might not be familiar with and we might even be able to suggest better, lesser-known options.

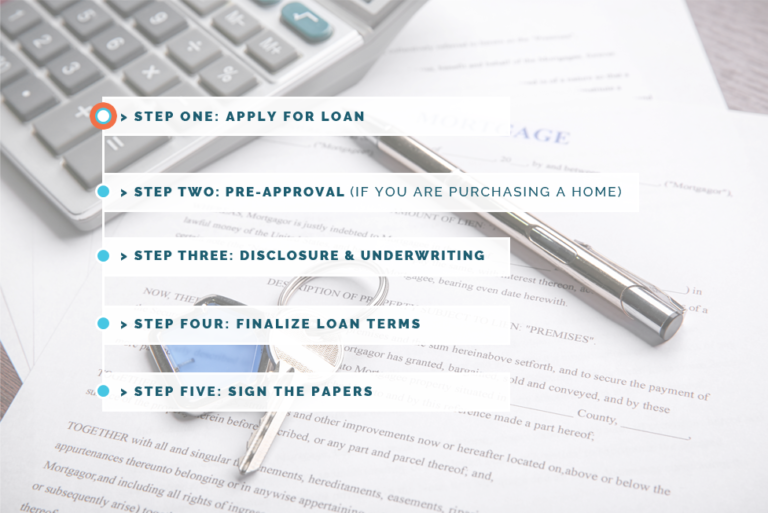

STEP 1

APPLY FOR LOAN

This is where we put our background in processing and underwriting to work for you. First, we provide a checklist that clearly explains the documentation needed. We then take the time to do a full review of your file, checking for red flags or inconsistencies that may slow down the loan process. We keep up a high degree of communication and make sure that you don’t make small mistakes, like taking on any additional debt, that can negatively affect the progression of the loan.

STEP 2

PRE-APPROVAL (IF YOU ARE PURCHASING A HOME)

A pre-approval moves you a big step closer to home ownership. It gives you confidence, proves your creditworthiness to sellers, and strengthens your ability to negotiate a sale.

STEP 3

DISCLOSURE AND UNDERWRITING

Disclosures are lender documents that spell out the details and terms of your loan. In this stage, buyers usually have a lot of questions and we take particular care to make sure that everything is clearly understood. It’s normal for underwriters to also have a few questions as well, and we keep in close contact to guide you through them.

STEP 4

FINALIZE LOAN TERMS

We will do one last check to make sure that we have set up your loan correctly. The files go back to the underwriter for a final review and once the documents are released, we will send you the complete loan documents so that you can take your time and give them a personal review. We are always just a phone call away to answer any final questions.

STEP 5

SIGN THE PAPERS

This is the fun part. By now, you are fully informed and prepared to confidently walk in and sit down with a notary. Once you sign the loan documents, funding will quickly follow.

Beyond securing the right loan for our clients, we want to take some of the mystery out of the mortgage process by making sure that they are informed and educated about all aspects of their home loan. We are always there for you to answer questions and give advice through all of the steps to buying or refinancing a home.

Whether you’re interested in a first-time purchase, or refinancing an existing mortgage, securing a great loan begins with a conversation.

THE TIME IS NOW! SCHEDULE A FREE CONSULTATION

Let us show how easy it is to that first step toward a better mortgage and a stronger financial future.

Give us a call at 562-378-0121 or schedule a FREE consultation and let’s get going.

Your Perfect Home Loan is Waiting for You.

Together, We Can Make It Happen.

“In over 30 years of buy and refinancing homes, Jody was by far the best!!! Jody was extremely prompt and responsive to any questions I had via email or phone. She was totally on target re: anticipated costs and timing in processing the refi, even in the crazy Covid 19 times. I highly recommend her.”

LANCE

“Jody made the process very easy. She was thorough, patient, efficient, and timely. She ensured I would get the best rate and I did. I messed up and failed to sign something at closing. She jumped on it right away and within 24 hours I returned the document and the funding dates was still met.”

MARY D.

“Jody was amazing during the refinance process. She was extremely patient & ensured that we got the absolute lowest rate possible. She was also very accessible & quick to respond via both email and phone. She spend whatever time was necessary to answer all of my questions. Definitely recommend!”

CASEY

“Jody Canfield was knowledgeable, responsive, & took great personal care to ensure all my questions were answered and I received the best possible rate. I was also provided a mobile notary who came directly to my home. I highly recommend working with Jody and her team.”